Fully Paid Securities

Lending

Understanding

Securities Lending

The loan agreement provides an overview of the terms and conditions related to the securities lending borrow-and-loan transaction as well as the remedy due to the borrower and lender in the event of a default. The agreements also cover the type of securities that can be loaned, which may include U.S. and foreign stocks, corporate bonds and government debt and may specify that the securities are "fully paid for," meaning that they are owned outright by the investor, and there is no margin held by the clearing broker.

The loan agreement provides an overview of the terms and conditions related to the securities lending borrow-and-loan transaction as well as the remedy due to the borrower and lender in the event of a default. The agreements also cover the type of securities that can be loaned, which may include U.S. and foreign stocks, corporate bonds and government debt and may specify that the securities are "fully paid for," meaning that they are owned outright by the investor, and there is no margin held by the clearing broker.

There are many reasons a financial institution may want to borrow securities, but generally it is done to support a trading strategy, cover short sales or satisfy customer possession and control requirements. Most borrowers seek securities that are considered “hard to borrow,” meaning they are difficult or unavailable to borrow due to limited supply. Can investors sell loaned shares?

Most securities lending programs allow investors who lend their shares to continue to trade as usual and sell them at any time without prior notice.

While investors do not receive dividend payments directly on the securities that are borrowed, securities lending programs traditionally offer substitute payments for dividends. However, investors may lose proxy voting rights on shares that are out on loan.

Collateral for these loans will be transferred to a trustee/custodian to protect an investor’s interests in the event of a Pershing insolvency. You should consult the loan agreement for specific information.

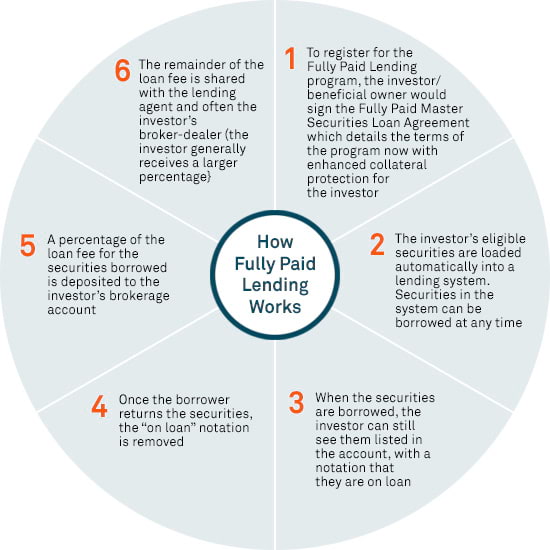

Securities lending provides a relatively easy way to gain incremental revenue on an existing portfolio. The borrower pays a loan fee for the securities that are borrowed. The lender receives the majority of the loan fee, and the remaining portion of the loan fee is shared with the lending agent or clearing broker and often the borrower’s broker-dealer. This fee will fluctuate based on market demand and securities will only be borrowed for a purpose (a loan or delivery need). Some lending agents or clearing brokers may also pay the lender a portion of the interest earned on the cash collateral in the account.

The main benefit of securities lending for investors is that it can help them to potentially generate additional income on securities they already own. There is also no cost to participate in these programs, and the investor does not usually have to do anything beyond sign the initial loan agreement. If securities are borrowed, loan fee payments are usually made automatically, often monthly, and investors receive substitute payments for dividends on loaned shares.

Risks include, but are not limited to, market fluctuation, tax implications, and Pershing’s default when participating in this program. The Fully Paid Master Securities Loan Agreement includes a full description of potential risks, and should be read carefully before participating in the program.

Investors should talk to their advisors to see if their firm offers a securities lending program and whether a securities lending program is suitable for them. To participate, investors will need to read and sign a loan agreement. Please keep in mind that most programs have eligibility criteria, such as a minimum asset level that must be in the portfolio to participate in the program.

Please keep in mind that securities lending programs will vary and investors should consult the loan agreement for details.

Ask how we can help transform

your business

Featured Solutions and Resources

Thousands of investment choices to meet diverse investor demands, plus a full lineup of resources to help advisors grow their retirement business.

Robust resources to help you transform your business.

Accelerate your growth with the expertise of our team of professionals.