June 5, 2025

Direct Indexing has been popular for a select group of investors for decades. But thanks to recent advances, its potential benefits are more widely available.

Direct indexing (DI) is not a new concept, and many select investors have benefited from the investment approach for years. Historically, DI strategies were primarily available for high-net-worth investors whose large portfolios justified the costs and human resources required to manage portfolios in a customized manner. DI’s recent rise in popularity is largely due to investment managers’ ability to streamline and efficiently manage the process through technology at scale. This has resulted in lower operating costs, which has opened the door to more investors to explore direct indexing’s potential benefits.

What Exactly Is Direct Indexing?

Direct indexing involves buying a sample of the stocks that make up a specific index (e.g., the S&P 500®). Unlike traditional vehicles like exchange-traded funds (ETFs) or mutual funds, this approach gives clients direct ownership of the individual stocks and allows for customization specific to their initially stated preferences and goals. For most DI clients, these goals are centered on realizing tax benefits and customizing their portfolio based on any number of investment views.

How Does Direct Indexing Work?

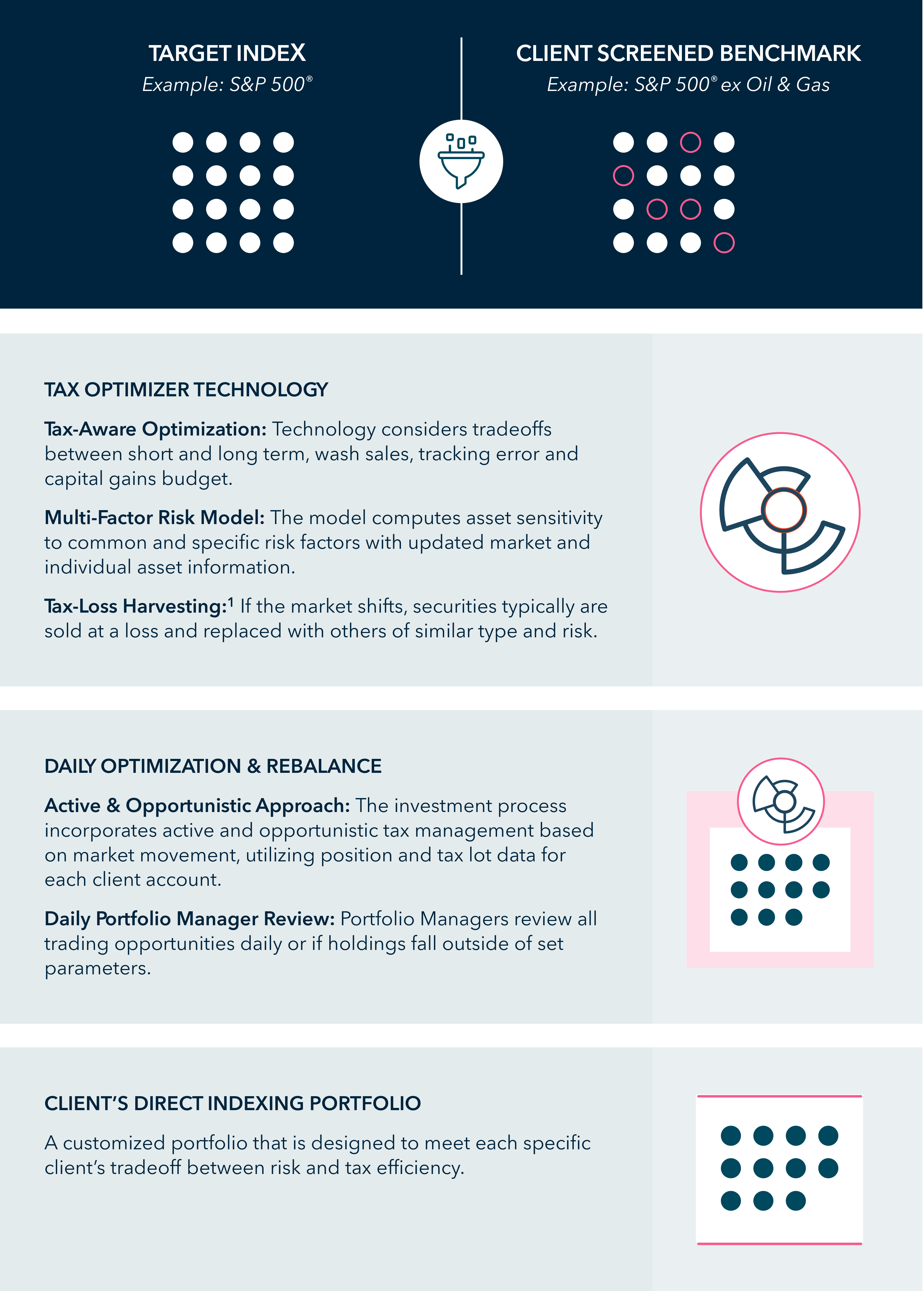

The portfolio largely aims to track the performance of the selected index. To set up a direct indexing portfolio, the investment manager:

- Chooses an index. This choice is based on the overall investment plan as selected by the advisor or client.

- Filters the stocks in the index, deciding which stocks to leave out and include. These decisions are based on the investment strategy goals.

- Buys the chosen stocks. The investment manager uses portfolio optimization software to select a basket of securities with similar risk and return characteristics as the target index. The portfolio optimizer is a tool used to find the best allocation of assets given the investor’s objectives within specific risk and return constraints.

- Systematically monitors the portfolio. The investment manager makes changes as needed, including buying and selling individual stocks as markets fluctuate with an objective to add after-tax benefit within the portfolio while maintaining market exposure.

What’s in It for the Client?

Potential tax benefits: With direct indexing, each client owns stocks at a different cost basis and during times of volatility in the market, the investment manager can sell stocks that have lost value and replace with stocks that provide similar exposure. This can help lower the taxes a client owes or offset gains in other investments. This is called tax-loss harvesting, and we’ll explore the process in greater detail later in the series.

Customization, personalization and diversification: An investment manager can make changes to a portfolio when an advisor’s clients’ needs or goals change. One example could be an executive of a large technology firm who may have a compensation package that includes shares of the company’s stock. This compensation would increase the executive’s exposure to the technology sector. Direct indexing would allow the executive to choose to hold fewer tech stocks than would than reflected within the index itself.

For other portfolios, the investment manager can help achieve the client’s goals by choosing not to buy certain stocks to reflect a client’s personal or mission-driven philosophies.

Is Direct Indexing Right for You?

Direct indexing gives advisors and their clients more control over their investments. Our Mellon investment experts can help determine whether a direct indexing strategy can complement your investment goals.

1There's no guarantee that a particular investor will realize significant tax benefits from harvesting gains or losses. Investment strategies that seek to employ tax management may be unable to fully realize strategic gains or harvest losses due to various factors. Market conditions and/or client account holdings may limit the ability to generate tax losses. Tax-loss harvesting involves the risks that the new investment could perform worse than the original investment and that transaction costs could offset the tax benefit. Also, a tax-managed strategy may cause a client portfolio to hold a security in order to achieve more favorable tax treatment or to sell a security in order to create tax losses. The ability to minimize tax consequences for a specific account may decrease as gains have the potential to accumulate over a period of time. Investors in lower tax brackets generally will not derive the same level of potential tax benefits from tax-managed strategies than those in higher tax brackets. Tax considerations, while important, are just one factor to consider before making any investment decision. Tax-managed investing and tax transitioning do not equate to comprehensive tax advice, are limited in scope and not designed to eliminate taxes in an account. Please consult your own tax advisor or financial professional for more detailed information on tax issues as they relate to your specific situation. Example shown is for illustrative purposes only and does not reflect actual results. The Standard & Poor's 500 (S&P 500) Index is a widely accepted, unmanaged index of US stock market performance. Investors cannot invest directly in an index.

Related Content

Ask how we can help transform your business