NOV 06, 2023

STEPHANIE HILL

Head of Index |Mellon

Driven by advances in technology and increases in investor demand, direct indexing has become one of the fastest-growing investment segments. In fact, Cerulli Associates projects direct indexing assets will top $800 billion by 2026,1 outpacing the growth of exchange-traded funds (ETFs), mutual funds and separately managed accounts (SMAs).

While direct indexing is known as a way to customize portfolios for investors, tax management typically is the No. 1 reason investors turn to direct indexing, according to a March 2023 Morningstar report.2

How Direct Indexing Helps Investors Manage Taxes

In short, direct indexing works by using technology and sophisticated algorithms that seek to replicate the performance of a specific index. Managers can use that same technology for tax optimization in an investor’s portfolio. Studies have shown that direct indexing portfolios may generate an average 1.08% of additional return (tax alpha) per year thanks to tax management.3

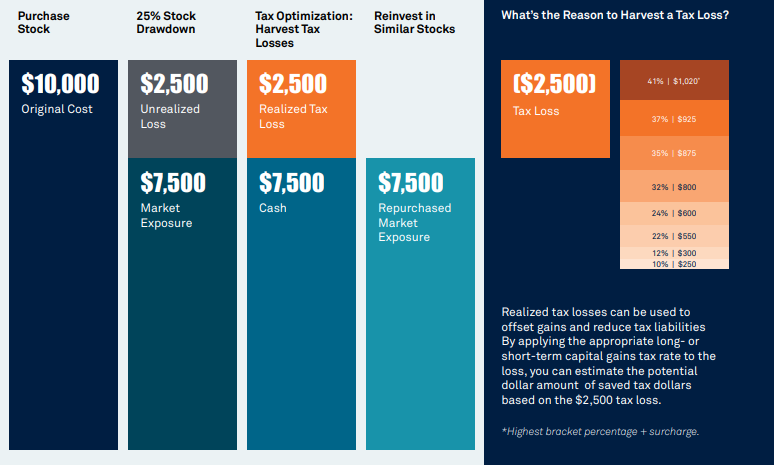

Here’s how. Direct indexing allows managers to use sophisticated technology to enact a process called “tax-loss harvesting.”4 This process is designed to sell investments that have declined in value to reduce capital gains taxes owed from selling profitable investments. By realizing capital losses, investors potentially can lower their overall tax liability. The same technology is also designed to help financial advisors manage the realized capital gains in their clients’ portfolios with an overall annual capital gains budget.

Keep in mind that these portfolios have a mandate to track an index, so whatever stocks are sold for tax harvesting are typically replaced in the portfolio from an overall risk perspective. Because of wash sale rules, a portfolio manager can’t simply sell a stock and immediately rebuy it. However, the technology and algorithms typically allow portfolio managers to find similar securities to help maintain the overall risk profile and characteristics of the benchmark. It helps that the benchmarks generally contain hundreds of securities.

In the scenario5 above, the portfolio manager identifies and sells a stock with an unrealized loss of $2,500 to reduce the investor’s tax liability. The portfolio manager then reinvests in similar stocks to continue to track the index. To calculate the potential amount saved for the investor, multiply the $2,500 loss by the appropriate capital gains tax rate.

The customization component of direct indexing can also help align a portfolio to an investor’s specific tax situation. For example, some direct indexing programs, like the one offered by Mellon and BNY Pershing, incorporate a Tax Transition Scenario Planner tool6 as part of the overall client experience. This tool examines a list of client holdings and provides several scenarios for a tax transition—each with a different capital gain and tracking error7 impact. With this integrated tool, an advisor can run this analysis on their own without involving the portfolio managers of the direct indexing strategy. The advisor can then discuss the potential costs, benefits and tax impact of each scenario with their clients prior to converting into a direct indexing portfolio.

The BNY Difference

The experience and technology of the provider can help enhance a direct indexing solution. Early entrants in the direct indexing space were more focused on the investment side than the technology side. Now, there are FinTech players that are heavy on the technology side and less experienced on the investment side. The combination of Mellon’s deep investment expertise and the technological know-how of BNY Pershing and its Wove platform is designed to provide advisors with customized solutions at scale to deliver tax-efficient, customized beta exposure to their clients.

BNY Precision Direct IndexingSM is designed to leverage Mellon’s 40 years of index management expertise and BNY Pershing’s technology to provide advisors and clients with institutional-quality, personalized index solutions. The solution is fully integrated into the Wove platform, making it easier for advisors to offer the potential benefits of direct indexing to a wider range of investors.

Contact your relationship manager to find out more about BNY and Mellon’s indexing capabilities.

Tax-Efficient Investing Through Direct Indexing

1The Case for Direct Indexing: Differentiation in a Competitive Marketplace, Cerulli Associates, December 2022.

2The Direct Indexing Landscape, Morningstar, March 2023.

3Tax alpha is the potential value generated by tax optimized solution based on the difference of excess pre-tax return and after-tax return. Estimates of tax alpha vary greatly across market conditions, but average to 1.08%, annualized over the period of study (1926 to 2018). Refer to the study: An Empirical Evaluation of Tax-Loss-Harvesting Alpha, Chaudhuri et al Financial Analysts Journal (2020).

4There’s no guarantee that a particular investor will realize significant tax benefits from harvesting gains or losses. Investment strategies that seek to employ tax management may be unable to fully realize strategic gains or harvest losses due to various factors. Market conditions and/ or client account holdings may limit the ability to generate tax losses. Tax-loss harvesting involves the risks that the new investment could perform worse than the original investment and that transaction costs could offset the tax benefit. Also, a tax-managed strategy may cause a client portfolio to hold a security in order to achieve more favorable tax treatment or to sell a security in order to create tax losses. The ability to minimize tax consequences for a specific account may decrease as gains have the potential to accumulate over a period of time. Investors in lower tax brackets generally will not derive the same level of potential tax benefits from tax-managed strategies than those in higher tax brackets. Tax considerations, while important, are just one factor to consider before making any investment decision. Tax-managed investing and tax transitioning do not equate to comprehensive tax advice, are limited in scope and not designed to eliminate taxes in an account. Investors should contact their own tax advisor or financial professional for more detailed information on tax issues as they relate to an investor’s specific situation.

5This material is provided for illustrative/educational purposes only. This material is not intended to constitute legal, tax, investment or financial advice. Effort has been made to ensure that the material presented herein is accurate at the time of publication. However, this material is not intended to be a full and exhaustive explanation of the law in any area or of all of the tax, investment or financial options available. The information discussed herein may not be applicable to or appropriate for every investor and should be used only after consultation with professionals who have reviewed your specific situation.

6The Tax Transition Scenario Planner tool is accessible in BNY Pershing’s Wove platform. Clients must be appropriately contracted to use the Wove platform and all the associated services and tools including Tax Transition Scenario Planner tool.

7Tracking error, also referred to as “active risk,” indicates how closely a portfolio’s returns have followed the benchmark’s returns. A higher tracking error suggests the portfolio has deviated more from the benchmark while a lower tracking error suggests the portfolio is more similar to the benchmark.

DISCLOSURE

The BNY Precision Direct Indexing product is offered through the BNY Mellon Advisors, Inc. (BNY Advisors) Managed360 Program and certain third- party wrap fee programs on the Pershing managed accounts platform. The product described in this presentation may be offered by associated persons of BNY Mellon Securities Corporation (BNYSC) acting in their capacity as investment adviser representatives. Mellon Investments Corporation (MIC) provides day-to-day investment advisory services. BNY Advisors, MIC and BNYSC are BNY Investments firms and investment advisers registered in the United States under the Investment Advisers Act of 1940. Pershing LLC, member FINRA, NYSE, SIPC, is a subsidiary of BNY. Pershing Advisor Solutions LLC, member FINRA, SIPC, and Pershing X, Inc., are affiliates of Pershing LLC. Investment advisory services, if offered, may be provided by one or more affiliates of BNY. Technology services may be provided by Pershing X.

This material has been provided for informational purposes only and should not be construed as investment advice or a recommendation of any particular investment product, strategy, investment manager or account arrangement, and should not serve as a primary basis for investment decisions. Prospective investors should consult a legal, tax or financial professional in order to determine whether any investment product, strategy or service is appropriate for their particular circumstances. This document may not be used for the purpose of an offer or solicitation in any jurisdiction or in any circumstances in which such offer or solicitation is unlawful or not authorized. Some information contained herein has been obtained from third party sources that are believed to be reliable, but the information has not been independently verified. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

BNY Investments is one of the world’s leading investment management organizations, encompassing BNY’s affiliated investment management firms and global distribution companies. BNY is the corporate brand of The Bank of New York Mellon Corporation and may be used to reference the corporation as a whole and/or its various subsidiaries generally.

Trademark(s) belong to their respective owners. The information contained herein, including any attachments, is proprietary to BNY. It may not be reproduced, retransmitted or redistributed in any manner without express written consent. This material does not constitute a guarantee by BNY of any kind. This material is for general information purposes only and is not intended to provide legal, tax, accounting, investment, financial or other professional advice on any matter. BNY is not responsible for updating any information contained within this material and information contained herein is subject to change without notice.

All investments involve risk, including the possible loss of principal. Certain investments have specific or unique risks. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. Past performance is no indication of future performance. Diversification does not ensure a profit or protect against a decline in a down market.

Not FDIC-Insured | No Bank Guarantee | May Lose Value

For Institutional Investors and Financial Professionals Only. Not intended for use by Retail Investors.

©2025 BNY Mellon Securities Corporation, 240 Greenwich St., New York, NY 10286.

MIC-660026-2024-12-23 | MICA-652414-2024-12-05

Related Content

Ask how we can help transform your business